As with many question of economic policy, this one is badly formulated. It may matter, to some extent whether we think the economy is going to grow at +0.1% or -0.1%, with zero demarcating the difference between a happy and unhappy future for all. And some people do believe in some notion of a stalling speed for an economy, under which low or negative growth rates are more likely to lead to sustained lower and more negative growth rates in future: such a view might be based on the conjecture on confidence-based feedback loops from growth to employment prospects and vice versa. But ultimately more or less growth over a short period is less important than the extent of spare capacity.

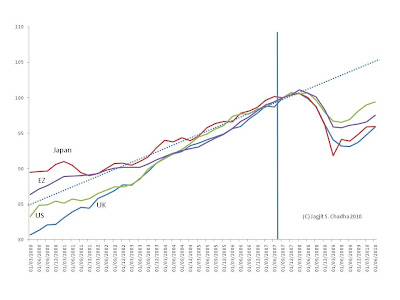

And so the questions about which we ought to be thinking hardest, are not only about the extent of spare capacity but whether it will ultimately be dissipated by strong positive growth in demand or the scrapping of output potential. If the former, the long-lived consequences of the financial crisis and subsequent economic recession would be minimal but if the latter then we may have to learn some very hard but also permanent lessons about relative impoverishment. The chart above shows real GDP in the UK, Euroland, Japan and the US relative to their level at the end of the second quarter of 2007, which you will recall was a month or so before the financial crisis took its grip and I have arbitrarily normalised that quarter’s GDP level to 100. I also draw a simple trend line (dotted line) from 2001 to 2010, which shows where we might have expected the income to be this year if we had been foolish enough to believe a straight-line forecast in 2007. Even though the various recessions seem to have ended, the gap between expected income and actual income remains very large. In general, we can see, there is a shortfall of around 5-10% between the expected level of GDP and current income. A double dip or not, what matters is the persistence of this gap, which can be only be eroded quickly by some combination of fast growth and supply side scrapping. When we consider the indebtedness of household balance sheets, a nervous corporate sector and a trickle of bank lending – it is difficult to see how demand will quickly erode the gap. And if the decision-makers on the supply side then think that the gap must be closed by scrapping output, then we will all be permanently worse-off. Double dip or not that is the real question.